SEC Puts Crypto Gaming in the Crosshair: Immutable Slapped With Wells Notice After Only One Interaction

The SEC has taken aim at a major crypto gaming project, Immutable.

Immutable has argued that it was offered little opportunity for constructive dialogue.

The SEC’s approach continues to attract criticism.

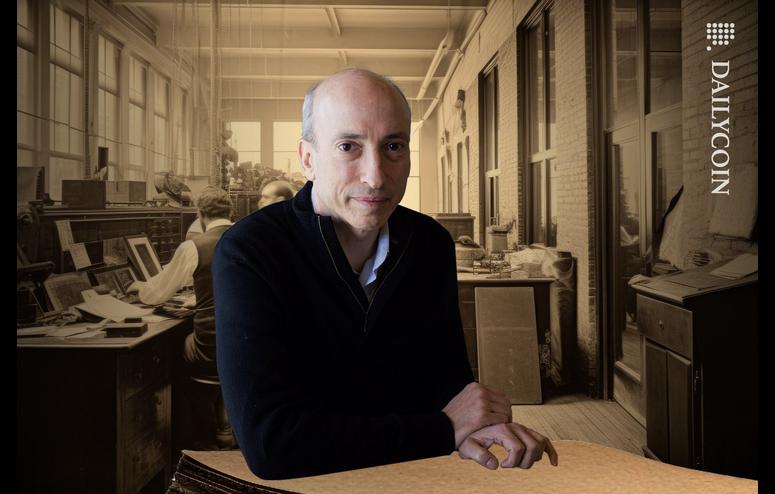

Despite the growing political pressure in D.C. and even a threat of a full-on restructuring from former president and current presidential candidate Donald Trump, the Gary Gensler-led SEC is not backing down from its stance that most crypto assets are securities, and decades-old securities laws are sufficient to guide the nascent market.

On the contrary, the agency appears to be doubling down. After going after centralized exchanges, DeFi projects, and NFT projects, the agency may now be looking to expand its net to cover crypto gaming.

Immutable Blindsided

The SEC has targeted a major crypto gaming project, Immutable. On Thursday, October 31, Immutable disclosed that it had received a Wells Notice from the SEC. The firm asserted that it was largely blindsided by the affront and left with little room for constructive engagement. Sponsored

“Prior to the issuance of a Wells notice, there are often multiple months of interviews and conversations between company counsel and the SEC, so the SEC can fully understand the situation. Instead, in our very first interaction with the SEC, we were told a Wells notice would be issued to the company within the week. We then received it within hours,” the firm wrote in its statement.

A Wells Notice is a letter from the SEC informing a firm of its plans to bring enforcement actions against it. It is typically a follow-up to an investigation and an indication that the agency has gathered enough evidence to take legal action.

According to Immutable, the Wells Notice they received alleged that they had violated securities laws and made misrepresentations to users without going into details about what these violations were.

“the notice simply cited statutory provisions and contained limited meaningful detail about the nature of the investigation - we counted fewer than 20 words of material explanation,” the firm wrote.

According to the crypto gaming firm, they only received specifics during a ten-minute call with the SEC after the Wells Notice had been issued.

“In a ten minute call after they had already issued us with a Wells notice, the SEC alleged a 2021 blog post stating a pre-launch investment made in the IMX token at a price of $0.10 ($10 pre 100:1 split) was inaccurate, and implied there was no exchange of value between the parties. Once again, the SEC is incorrect: there was real consideration, which they would have learned through a constructive dialogue with the company,” the firm lamented.

The SEC declined to comment when contacted by DailyCoin.

Meanwhile, Immutable also disclosed that separate notices were issued to the firm’s CEO and Digital Worlds Foundation, the parent entity of the IMX token issuers. At the same time, the firm asserted that it was aware of related inquiries from the U.S. Department of Justice but no proposed legal actions.

Unsurprisingly, the SEC’s efforts have triggered strong reactions from the crypto industry, with many taking offense at the approach.

An Attempt to Obtain a Quick Settlement?

Reacting to the news, Variant CLO Jake Chervinsky lambasted the SEC for its alleged practice of sending crypto firms vague Wells Notices that made it difficult for them to respond.

“Wells notices are supposed to be part of a neutral and fair process giving investigation targets a chance to explain why the SEC shouldn't enforce against them. There is no justification for sending Wells notices like this. The current SEC isn't even pretending to be fair,” he stressed.

Expressing a similar sentiment, Willkie Farr & Gallagher partner Mike Selig questioned whether the SEC was attempting to force a settlement.

“SEC purportedly issued a Wells notice to Immutable for alleged securities law violations within hours of initiating its investigation. SEC typically does so after months of investigation. Seems like an attempt to get a quick settlement before a potential change in administration,” he asserted.

Whatever the case, Immutable has committed to fighting the SEC in court, expressing confidence in its position and finances.

“Immutable remains well capitalized with a large war-chest to build for the future of gaming. SEC overreach and political calendars won't stop us; they won’t stop the industry; they won’t stop the inevitability of digital property rights,” the firm asserted.

On the Flipside

The SEC has not followed up the Wells Notice with a legal complaint.

Immutable has a chance to respond to the Wells Notice with reasons why the SEC should not take legal action.

Why This Matters

The SEC’s Wells Notice against Immutable suggests a potential expansion of the agency’s so-called regulation-by-enforcement campaign against crypto.

Read this for more on the SEC’s crypto enforcement actions:How SEC Puts DeFi on Notice with Rari Capital Charges

See how Bitget is making crypto payments easier than ever for its users:Bitget Is Unlocking Zero-Fee Crypto Payments for Users: Here’s How