Digital Assets: Week in Review

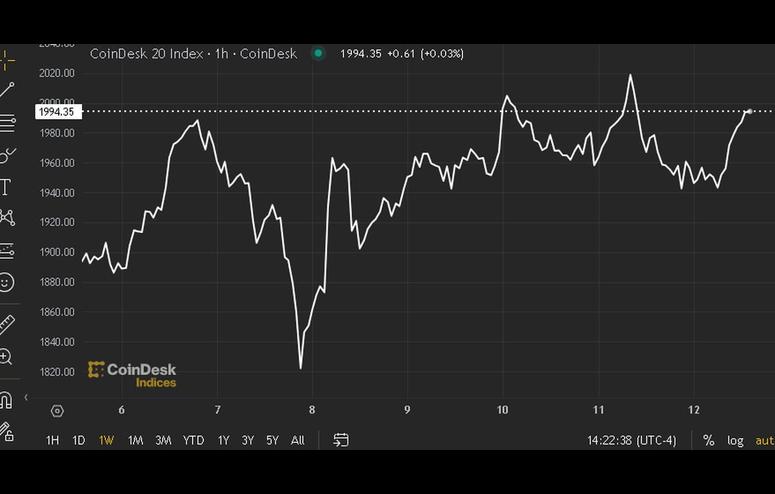

The crypto market finds itself in the summer doldrums, reflecting a period of stagnation following a tumultuous spring. The CoinDesk 20 Index, a barometer for the industry's health, declined by 11% this week, closing at 1919.91 on Monday. This drop, with all 20 assets registering losses and 16 recording double-digit declines, underscores the current bearish sentiment. Despite this, the index maintains a year-to-date gain of over 10%, hinting at the underlying resilience and potential for recovery in the market.

Among the assets, Solana (SOL) and Polkadot (DOT) emerged relatively unscathed, losing 6.2% and 6.3%, respectively. Their resilience amid the broader downturn highlights investor confidence in these projects' long-term viability. In stark contrast, Aptos (APT) suffered the most significant decline, plummeting by 19% week-to-date. This divergence in performance within the index offers a glimpse into the varied risk profiles and investor perceptions across different blockchain projects.

The CoinDesk 20 Index's latest quarterly rebalance and reconstitution also marked significant changes. Dogecoin and Shiba Inu, previously mainstays of the index, were removed, making way for Hedera and Render. This shift signals a broader trend within the crypto market towards prioritizing innovative and cutting-edge blockchain projects over meme-based assets. The inclusion of Hedera and Render aligns with an industry-wide focus on technological advancement and real-world applications, positioning the index as a reflection of the market's forward-looking outlook.

The current market stagnation is partly attributed to the drop in Bitcoin's hashrate following the latest halving event this spring. This decrease in mining activity has tempered the bullish momentum that often accompanies halving cycles. Meanwhile, the market eagerly anticipates the launch of Ethereum ETFs, which could inject fresh capital and interest into the sector. Additionally, global Bitcoin mining companies are in the process of accumulating new miners, set to be deployed in the coming months, potentially boosting the hashrate and reinforcing the network's security and robustness.

Looking ahead, there appears to be a confluence of positive fundamentals that could reignite a crypto rally post-summer. The anticipated launch of the Ethereum ETFs, coupled with a projected increase in Bitcoin's hashrate, creates a favorable environment for market growth. Moreover, macroeconomic factors, such as the Federal Reserve's potential shift towards cutting rates after an extended period of hikes, could further stimulate investment into risk assets, including cryptocurrencies.

While the crypto market is currently navigating through a phase of consolidation and reduced activity, the horizon holds promising developments. The resilience of projects like Solana and Polkadot, the strategic realignment of the CoinDesk 20 Index, and the impending catalysts in the form of Ethereum ETFs and increased mining activity collectively point towards a potential resurgence. Investors with a long-term perspective may find this an opportune moment to position themselves ahead of the anticipated market upturn.

Authors' views and opinions are their own and not associated with CoinDesk Indices.