$100B Illegal Crypto Surge Hits Stablecoins, Exchanges! - Coincu

BTC $57636.186 -0.04%

ETH $3123.494 0.19%

BNB $526.846 0.51%

XRP $0.445 2.70%

BTC ETH BNB ADA SOL AVAX DOGE LINK TRX

USD EUR GBP JPY AUD CAD CHF CNY

Convert

LIVE UPDATES • BlockDAG’s Dev Release 70 Highlights X1 Miner’s Upgrades as App Goes Live on Apple Store; Presale Value Surges by 1300% • BNB Chain Hack Loses $1.6B, Immunefi Investigation Unveils! • US Lawmakers Demand Release Binance Executives by Nigerian Government! • Tether USDT Redemptions Will Be Stopped on Multiple Blockchains in 2025 • Hamster Kombat Second Airdrop Will Be Launched In The Next 2 Years • SEC Investigation Into Paxos Now Ends With Softer BUSD Classification • Iggy Azalea’s MOTHER Token Surges 47% Post DWF Labs Partnership! • TRON ($TRX) and XRP ($XRP) Shine, But DigiHorse Empires ($DIGI) is the Next Big Thing You Can’t Afford to Miss • JPMorgan Crypto Prediction Shows A Strong Market Rebound In August • DefiLlama Founder Warns: 100+ Crypto Domains Vulnerable to Attacks!

News $100B Illegal Crypto Surge Hits Stablecoins, Exchanges! 3 hours ago - Around 2 mins mins to read

Key Points:

JPMorgan predicts a significant rebound in the crypto market for August, anticipating an end to liquidation activities.

The forecast offers strategic insights for investors looking to capitalize on potential market recovery and stability.

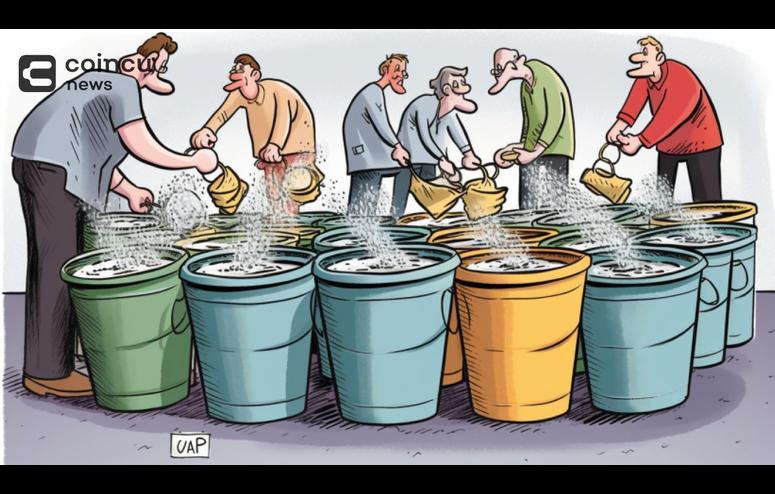

Chainalysis researchers indicate that nearly $100 billion in illegal crypto surge funds have been laundered through dark pools of digital wallets since 2019.

According to Kim Grauer, head of research at Chainalysis, criminals are unprecedentedly rinsing stablecoins for illegal crypto surge transactions. More than half of these suspicious funds eventually enter centralized exchanges, offering them high liquidity, ease of conversion between cryptocurrencies and fiat currencies, and deep integration with traditional financial systems—making them ideal for laundering illegal crypto surge funds.

Impact on Global Exchanges Revealed

Research also identified the source of illicit money flows, which range from dark web markets through ransomware and malware to fraudulent schemes. Chainalysis identified five large centralized exchanges as key hubs for illegal crypto surge fund activities, although it refrained from naming particular exchanges. In addition to traditional exchanges, criminals use decentralized financial services, gambling sites, cryptocurrency mixers, and blockchain cross-chain bridges to conceal illegal funds’ origin.

On the bright side, Grauer pointed out that tighter regulations and exchange vigilance reduced suspicious fund inflows from their peak of close to $2 billion per month to just around $780 million monthly.

Chainalysis has tracked an increase in the number of intermediate digital wallets hosted by exchanges that follow Know Your Customer principles; these are wallets that, in essence, serve as a sort of financial laundry system to drive money through them and conceal its illicit origin, a method for avoiding detection.

Illegal Crypto Illegal Crypto Surge illegal funds

Author Annie

Championing positive change through finance, I've dedicated over eight years to sustainability and environmental journalism. My passion lies in uncovering companies that make a real difference in the world and guiding investors towards them. My expertise lies in navigating the world of sustainable investing, analyzing ESG (Environmental, Social, and Governance) criteria, and exploring the exciting field of impact investing. "Invest in a better future," I often say. That's the driving force behind my work at Coincu – to empower readers with knowledge and insights to make investment decisions that create a positive impact.

Related Posts

Bitcoin ETF Inflow Sees Surge Admid Market Downturn DefiLlama Founder Warns: 100+ Crypto Domains Vulnerable to Attacks! Protecting Investors: South Korea Enforces Customer Refunds for Failed Crypto Exchanges High Court Freezes Craig Wright Assets, Orders £1.548M Payment Of Legal Fees New Paxos Singapore Executive Director Appointed to Enhance Market Expansion Malaysian Crypto Miners Stole $722 Million in Electricity from 2018 SEC Investigation Into Paxos Now Ends With Softer BUSD Classification Silvergate SEC Settlement Will Be Finalized With $63 Million Fine

$100B Illegal Crypto Surge Hits Stablecoins, Exchanges!

Key Points:

JPMorgan predicts a significant rebound in the crypto market for August, anticipating an end to liquidation activities.

The forecast offers strategic insights for investors looking to capitalize on potential market recovery and stability.

Chainalysis researchers indicate that nearly $100 billion in illegal crypto surge funds have been laundered through dark pools of digital wallets since 2019.

According to Kim Grauer, head of research at Chainalysis, criminals are unprecedentedly rinsing stablecoins for illegal crypto surge transactions. More than half of these suspicious funds eventually enter centralized exchanges, offering them high liquidity, ease of conversion between cryptocurrencies and fiat currencies, and deep integration with traditional financial systems—making them ideal for laundering illegal crypto surge funds.

Impact on Global Exchanges Revealed

Research also identified the source of illicit money flows, which range from dark web markets through ransomware and malware to fraudulent schemes. Chainalysis identified five large centralized exchanges as key hubs for illegal crypto surge fund activities, although it refrained from naming particular exchanges. In addition to traditional exchanges, criminals use decentralized financial services, gambling sites, cryptocurrency mixers, and blockchain cross-chain bridges to conceal illegal funds’ origin.

On the bright side, Grauer pointed out that tighter regulations and exchange vigilance reduced suspicious fund inflows from their peak of close to $2 billion per month to just around $780 million monthly.

Chainalysis has tracked an increase in the number of intermediate digital wallets hosted by exchanges that follow Know Your Customer principles; these are wallets that, in essence, serve as a sort of financial laundry system to drive money through them and conceal its illicit origin, a method for avoiding detection.

Visited 29 times, 29 visit(s) today

Other Posts

Related Posts

- 13 hours ago 2 mins

German Government Bitcoin Available Now Less Than $1 Billion Left to Sell

Knowledge

- 180 days ago 13 mins

Crypto To Crypto Converter: Detailed Guide For Beginners And Important Notes

Knowledge

- 180 days ago 12 mins

Fiat To Fiat Converter: Detailed Guide For Beginners And Important Notes

Knowledge

- 115 days ago 10 mins

Buy Dogecoin on eToro: Step-by-Step Guide for Beginners (2024)

Knowledge

- 126 days ago 13 mins

Free Bitcoin Code 2024: Easy Way To Own Bitcoin

Top Projects

- 92 days ago 27 mins

Top 10 Best Crypto Telegram Bots In 2024

- 14 hours ago 2 mins

Crypto Supporter Donald Trump to Address Bitcoin 2024 Conference in Nashville

Knowledge

- 81 days ago 13 mins

Bitcoin Mining: How Long Does It Take to Mine 1 Bitcoin?

24h 7D 30D Trending

- 13 hours ago 2 mins

German Government Bitcoin Available Now Less Than $1 Billion Left to Sell

- 2 days ago 2 mins

BlackRock Spot Bitcoin ETF Returns Positive With $121.3M Inflows

- 2 days ago 2 mins

BLAST Token Holders Will Be Supported With 2x Points In The Future

- 1 days ago 2 mins

ETH Futures Skyrocket to 3.1M, Hinting at Ethereum ETF Approval!

- 1 days ago 2 mins

Softer CPI and Labor Data May Prompt Fed Rate Cuts in September and December!

- 7 days ago 2 mins

Hamster Kombat’s Token Will Launch on TON Blockchain With Breakthrough Milestones

Knowledge

- 4 days ago 13 mins

Pi Network Mainnet Launch Date: Potential for a Boom in Late 2024?

- 7 days ago 2 mins

- 6 days ago 3 mins

Ether.fi Season 2 Airdrop Claim Will Be Postponed to July 6

- 4 days ago 2 mins

Bitcoin Faces Pressure Amid Mt. Gox’s Compensation and Market Caution

Knowledge

- 30 days ago 9 mins

Save Up To 35% With Exclusive Cashback Trading Code From Coincu

- 28 days ago 2 mins

Bitcoin Whale Wallets With Over 1,000 BTC Are Almost At A New All Time High

Press Releases

- 21 days ago 5 mins

After Raising $5 Million, Sealana Announces Presale Ends in 5 Days – Last Chance to Buy

- 26 days ago 3 mins

LayerZero Token Airdrop Rules Announced, Early Transactions Will Be Eewarded 3x

Press Releases

- 16 days ago 5 mins

PlayDoge ($PLAY) Achieves $5 Million Milestone in ICO, a Tamagotchi-Style Meme Coin

Latest

view more

- 8 mins ago 4 mins

8 mins ago

11 Jul

BlockDAG’s Dev Release 70 Highlights X1 Miner’s Upgrades as App Goes Live on Apple Store; Presale Value Surges by 1300% July 11, 2024

- 34 mins ago 2 mins

34 mins ago

11 Jul

BNB Chain Hack Loses $1.6B, Immunefi Investigation Unveils! July 11, 2024

- 58 mins ago 2 mins

58 mins ago

11 Jul

US Lawmakers Demand Release Binance Executives by Nigerian Government! July 11, 2024

TOP Casino Projects

view more

Press Release

view more

- 8 mins ago 4 mins

8 mins ago

11 Jul

BlockDAG’s Dev Release 70 Highlights X1 Miner’s Upgrades as App Goes Live on Apple Store; Presale Value Surges by 1300%

- 2 hours ago 4 mins

2 hours ago

11 Jul

TRON ($TRX) and XRP ($XRP) Shine, But DigiHorse Empires ($DIGI) is the Next Big Thing You Can’t Afford to Miss

- 4 hours ago 5 mins

4 hours ago

11 Jul

Key Points:

JPMorgan predicts a significant rebound in the crypto market for August, anticipating an end to liquidation activities.

The forecast offers strategic insights for investors looking to capitalize on potential market recovery and stability.

Chainalysis researchers indicate that nearly $100 billion in illegal crypto surge funds have been laundered through dark pools of digital wallets since 2019.

According to Kim Grauer, head of research at Chainalysis, criminals are unprecedentedly rinsing stablecoins for illegal crypto surge transactions. More than half of these suspicious funds eventually enter centralized exchanges, offering them high liquidity, ease of conversion between cryptocurrencies and fiat currencies, and deep integration with traditional financial systems—making them ideal for laundering illegal crypto surge funds.

Impact on Global Exchanges Revealed

Research also identified the source of illicit money flows, which range from dark web markets through ransomware and malware to fraudulent schemes. Chainalysis identified five large centralized exchanges as key hubs for illegal crypto surge fund activities, although it refrained from naming particular exchanges. In addition to traditional exchanges, criminals use decentralized financial services, gambling sites, cryptocurrency mixers, and blockchain cross-chain bridges to conceal illegal funds’ origin.

On the bright side, Grauer pointed out that tighter regulations and exchange vigilance reduced suspicious fund inflows from their peak of close to $2 billion per month to just around $780 million monthly.

Chainalysis has tracked an increase in the number of intermediate digital wallets hosted by exchanges that follow Know Your Customer principles; these are wallets that, in essence, serve as a sort of financial laundry system to drive money through them and conceal its illicit origin, a method for avoiding detection.

Visited 29 times, 29 visit(s) today