US slams Binance after 'historic' settlement, says crypto exchange only 'pretended to comply'

U.S. authorities slammed Binance on Tuesday at a press conference held to announce what they said was a historic settlement that will see the crypto exchange pay $4.3 billion in penalties and forfeiture after felony guilty pleas.

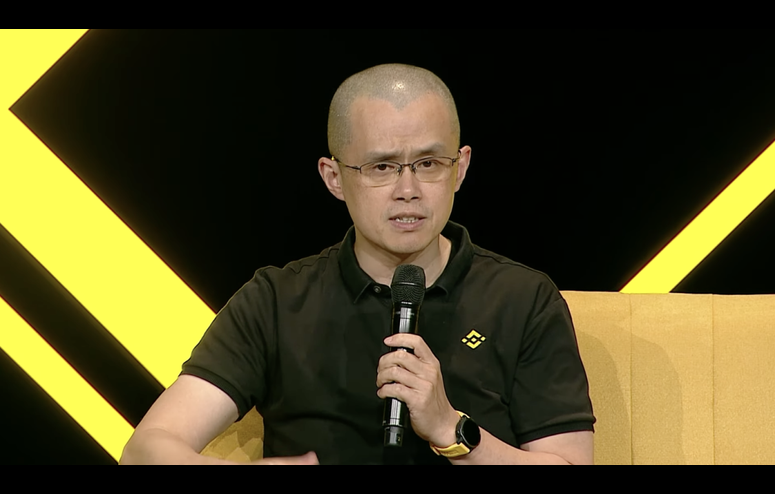

Binance agreed to plead guilty to violating the Bank Secrecy Act, knowingly failing to register as a money transmitting business, and willfully violating the International Emergency Economic Powers Act, Attorney General Merrick B. Garland said. CEO Changpeng Zhao also pled guilty to willfully violating the Bank Secrecy Act and stepped down.

"From the very beginning, Zhao and other Binance executives engaged in a deliberate and calculated effort to profit from the U.S. market without implementing the controls required by U.S. law," Garland said, adding that the exchange enabled transactions between American users and sanctioned entities.

Specifically, Garland said Binance facilitated $900 million in transactions between U.S. and Iranian users, while also supporting transactions between U.S. users and entities in Syria and in the Russian-occupied Ukrainian regions of Crimea, Donetsk and Luhansk.

'Stolen funds'

"Its platform accommodated criminals across the world who used Binance to move their stolen funds and other criminal proceeds," he continued. "Binance prioritized its profits over the safety of the American people."

"Binance also did more than just fail to comply with federal law – it pretended to comply," he added.

Commodity Futures Trading Commission chairman Rostin Behnam said that Zhao will have to pay $150 million in penalties to the CTFC. The regulator also announced that former Binance Chief Compliance Officer, Samuel Lim, agreed to a proposed consent order for permanent injunction that will see him pay a $1.5 million civil monetary penalty.

"The message here should be clear: Using new technology to break the law does not make you a disruptor. It makes you a criminal," Garland said. "This Justice Department has no tolerance for crimes that threaten our economic institutions and undermine public trust in the fairness of those institutions. And we will hold accountable the individuals who commit and profit from them."

Deputy Attorney General Lisa Monaco said the case should serve as a lesson to the industry that ignoring laws "is not a path to riches but a path to federal prosecution."

"Rather than implement the basic anti-money laundering safeguards that his team recommended – safeguards required by U.S. law – Binance and its founder operated as though the rules didn’t apply," she said. "Crypto assets may be advertised as borderless in nature, but the Department of Justice will enforce U.S. law across and throughout crypto markets, even in their darkest corners."

U.S. Treasury Secretary Janet Yellen said that FinCEN, OFAC and the IRS Criminal Investigation division have been investigating Binance for three years. The enforcement actions the U.S. government is taking against crypto exchanges are "not meant to end cryptocurrency activities but they must comply with the U.S. law," Yellen added.

Investigations and lawsuits

Binance came under scrutiny by the U.S government earlier this year.

THE SCOOP Keep up with the latest news, trends, charts and views on crypto and DeFi with a new biweekly newsletter from The Block's Frank Chaparro By signing-up you agree to our Terms of Service and Privacy Policy EMAIL Also receive The Daily and our weekly Data & Insights newsletters - both are FREE By signing-up you agree to our Terms of Service and Privacy Policy

In May, the DOJ began investigating Binance over whether it allowed Russian users to evade sanctions. In October, U.S. lawmakers asked the DOJ to "carefully evaluate the extent to which Binance and Tether are providing material support and resources to support terrorism" in the the Israel-Hamas war.

The exchange has been also been grappling with lawsuits from U.S. financial regulators.

In March, the CFTC sued Binance for a "willful evasion of federal law" and "operating an illegal digital asset derivatives exchange." The complaint alleged that Binance staff knew its users were conducting illicit activities but looked the other way.

In June, the Securities and Exchange Commission filed a lawsuit against the exchange and affiliated companies, arguing that the firms allegedly lied to customers and misappropriated funds.

C-suit quits

Amid the tumultuous year, a number of Binance top managers quit, and the company made significant layoffs in May and July.

Top departures included general counsel Han Ng, chief strategy officer Patrick Hillmann and SVP for compliance Steven Christie, who resigned in July. Before that, Matthew Price, a former IRS agent hired by Binance to manage global investigations and intelligence, also quit, while the exchange's Asia-Pacific head Leon Foong left in August.

In September, Binance.US president and CEO Brian Shroder quit, and the branch reportedly cut a third of its staff. Binance also lost its global head of product Mayur Kamat, head of Binance UK Jonathan Farnell, head of Eastern Europe, Turkey, Australia and New Zealand Gleb Kostarev and general manager for the CIS region Vladimir Smerkis.

Binance responds

Binance said in an emailed statement that it was confident the company can now emerge stronger as it lays the "foundation for the next 50 years."

"With the compliance and governance enhancements enshrined in our commitments, we can begin to share our vision for Binance’s exciting future and the future of the crypto industry," it said. "While Binance is not perfect, it has strived to protect users since its early days as a small startup and has made tremendous efforts to invest in security and compliance."

"We acknowledge that alongside compliance, transparency is essential to rebuilding industry confidence amid challenging market conditions and industry mismanagement," it continued.

Binance maintains around 150 million users and thousands of employees, the firm's new CEO Richard Teng said on the social media platform X.