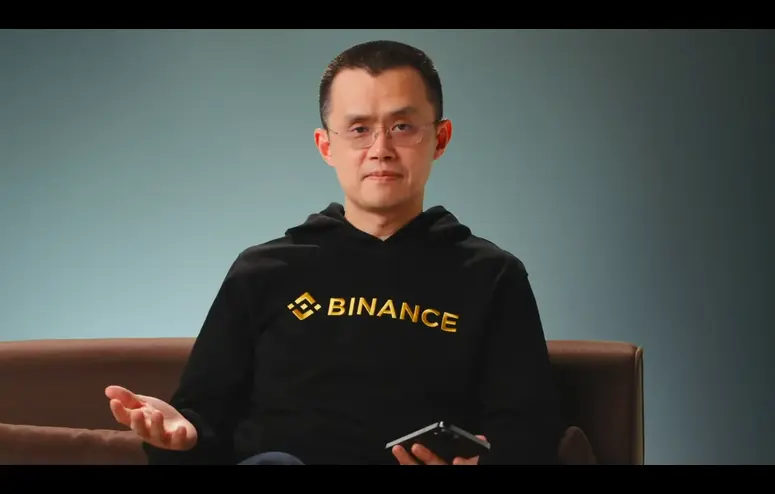

SEC Accuses Binance.US of Non-Cooperation

The United States Securities and Exchange Commission (SEC) has escalated its confrontation with Binance.US, alleging a lack of cooperation on September 14th.

In a recent court filing, the SEC criticized Binance.US, accusing its holding company, BAM, of providing only a paltry 220 documents during the discovery process.

Many of these documents, as per the SEC’s assertion, were plagued by unintelligible content, lacking essential dates or signatures.

The SEC further accused BAM of evading the production of vital witnesses for deposition, opting to cooperate with only four depositions it considered suitable.

Moreover, the regulatory body claimed that Binance.US responded to requests for pertinent communications with blanket objections, and conveniently asserted that certain documents crucial to their business operations did not exist.

Ironically, the SEC later obtained some of these supposedly non-existent documents from alternative sources, raising serious concerns about the exchange’s transparency.

The SEC also voiced apprehensions about Binance.US’s utilization of Ceffu, a wallet custody software provided by global entity Binance Holdings Ltd.

Inconsistent statements from BAM regarding Ceffu’s role in wallet and customer funds management drew the SEC’s attention.

Initially, BAM had declared Ceffu as its wallet custody software and service provider but later switched its stance to claim that Binance fulfilled this role.

This inconsistency led the SEC to question whether Binance.US’s use of Ceffu contravened a prior agreement designed to prevent fund diversion overseas.

The SEC’s legal battle against Binance commenced on June 5th, with the regulatory body leveling 13 charges against the crypto exchange.

These charges encompassed unregistered securities offerings, as well as allegations related to the Simple Earn and BNB Vault products and its staking program.

According to the SEC, Binance.com, Binance.US, and BAM Trading should have registered as clearing agencies, broker-dealers, and exchanges, respectively.

Furthermore, the unregistered sale of Binance.US’ staking-as-a-service program necessitated BAM Trading to register as a broker-dealer.

The departure of CEO Brian Shorder and a string of high-ranking executives, including the head of legal and the chief risk officer, have raised questions about the exchange’s stability and management. Binance.US has yet to provide a response to these latest accusations.

Other Stories:

Prominent Executives Predict Bitcoin Could Surpass $100,000 in 2024

Former PayPal President Predicts Bitcoin Lightning Network Revolutionizing Global Payments

2023 Crypto Venture Capital Funding Plummets As Industry Faces Uncertain Times