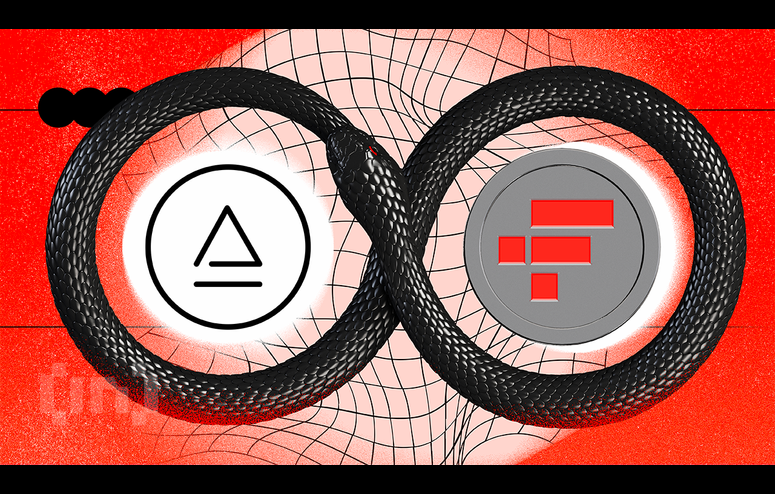

FTX Accuses LayerZero of Exploiting Alameda's Financial Difficulties

In a recent court filing, the FTX Debtors assert that bridge protocol LayerZero exploited Alameda Research’s precarious financial situation mere hours before the day of bankruptcy.

“In a November 10, 2022 letter to its investors, LayerZero all but admitted to exploiting Alameda Ventures,” the filing stated.

LayerZero Noticed Alameda Research Struggling

A recent FTX court filing indicates that LayerZero sought to benefit from FTX’s sister company’s financial difficulties by initiating a loan recall for a multi-million debt.

“LayerZero sought to capitalize on Alameda Research’s distressed financial position by demanding immediate repayment of its $45 million loan to Alameda Research.”

The debtors further allege that LayerZero was well aware of the entity’s financial difficulties. They claim the company used the opportunity to broker a favorable deal for the firm.

To learn more about the downfall of FTX, read BeInCrypto’s guide: FTX Collapse Explained: How Sam Bankman-Fried’s Empire

LayerZero allegedly negotiated a quick sale with Caroline Ellison, the CEO of Alameda Research at the time.

The deal allegedly involved Alameda transferring “its entire 4.92% equity stake in LayerZero to LayerZero” in exchange for forgiving the $45 million loan owed by Alameda Research.

The filing indicates that LayerZero ultimately secured a significantly more favorable agreement. The FTX investment arm transferred a considerably larger amount through last-minute transactions compared to what LayerZero gave in return.

It explained that LayerZero forgave the $45 million loan and, in exchange, got equity worth nearly $150 million.

Ex-Alameda Employee Shares Insider Experience

Aditya Baradwaj, a former employee at Alameda Research, recently disclosed his experience working for the now-defunct investment firm. He challenges the prevailing public perception that FTX and Alameda ever possessed corporate autonomy:

“Despite the fact that on paper, Sam had already transitioned to running FTX full-time, in practice both companies were highly intertwined. Joint offices, social events, and housing arrangements between both companies was the norm.”

However, he revealed that he experienced an extravagant lifestyle, from private jets to mingling with celebrities and political figures.

At the same time, he reportedly observed major flaws. “Careless risk management for a company handling billions of dollars in capital,” Baradjwaj stated.