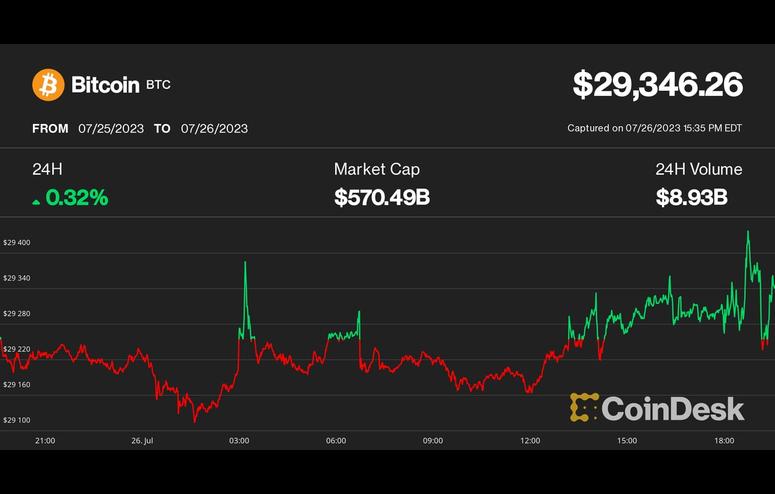

Bitcoin Remains in Tight Range Around $29.3K; Stellar's XLM Leads Altcoin Gainers

Bitcoin (BTC) is little-changed over the past 24 hours at $29,300 as the European Central Bank (ECB) as expected hiked its benchmark interest Thursday by 25 basis points to 4.25%. This followed yesterday's 25 basis point rate boost from the U.S. Federal Reserve (Fed).

Investors also received some fresh economic news to chew on, with the first estimate for U.S. GDP growth in Q2 coming in stronger than expected at 2.4% on an annualized basis. Economist forecasts had been for 1.8%. The GDP price index rose just 2.6% versus 3% expected and down from 4.1% in Q1, confirming the slowdown in inflation that was evident in the previously released monthly CPI data.

See more: Get professional-grade crypto data and news at CoinDeskMarkets.com

The CoinDesk Market Index (CMI) is ahead by 0.3%, led by a 2.6% advance for the CoinDesk Computing Index (CPU).

Stellar Lumens' XLM token is leading altcion gainers, rising just shy of 12% over the past 24 hours.

The Stellar Foundation issued a research report detailing its off-ramps on Wednesday. The report stated "USDC running on the Stellar blockchain is the asset that’s supported by the greatest number of cash offramps, with an estimated 322,000 locations supporting it. XLM, the Stellar blockchain’s native asset, is supported by 26,221 off-ramps." The second most supported asset in terms of cash off-ramps was bitcoin, said the report.

According to Christopher Newhouse, an independent crypto derivatives trader, the uptick in XLM on Wednesday looks to be caused by traders and speculators digesting the report and picking out "the narrative of real-world adoption through metrics of things like on and off-ramps and strategic global partnerships."

"Once a narrative type trade with organic buying pressure surfaces, momentum often continues in the same direction until we start seeing leveraged trades on the opposite side enter to stall out the move."

He noted that traders saw the report as an opportunity for a more fundamental based trade/move to continue on the back of the narrative that XLM is one of the most well connected and integrated for USDC cash off-ramps.

Elsewhere, Chainlink (LINK) is ahead 6% and Solana (SOL) 3%. Top metaverse and gaming tokens like SAND and AXS nursed losses even after Meta's Mark Zuckerberg reaffirmed commitment to the Metaverse vision.

“On one side, the bulls are waiting for further signals for the Bitcoin ETF SEC decision in August and positioning for the 2024 halving,” Adrian Wang, CEO of Metalpha, told CoinDesk. “On the other side, a lot of profit-takings can occur when the spot is above 30k, while the bears are positioning for another potential drop before 2024 halving, similar to what happened in 2019.”

The Fed announcement "doesn’t change the story related to crypto," said Lex Sokolin, managing partner of Web3 investment fund Generative Ventures. "We are already in a risk-off environment. Things could maybe get more catastrophic with war or recession, but tech and finance are at a fairly stable compressed valuation, with AI perhaps being an outlier."

“The market’s response to the Fed’s interest rate hike has been relatively calm, as the hike was largely predicted. It is worth to continue monitoring whether the latest marks the end of the current cycle of rate hikes,” Greta Yuan, Head of Research, at Hong Kong-based digital asset platform VDX told CoinDesk in a note.

“We can afford to be a little patient, as well as resolute, as we let this unfold,” Fed Chair Jerome Powell said in a press conference Wednesday. “We think we’re going to need to hold, certainly, policy at restrictive levels for some time, and we’d be prepared to raise further if we think that’s appropriate.”