💸 Blur Dives Into NFT Lending - The Defiant

TL;DR The South Korean government has approved the launch of two crypto funds, which will be operated by crypto exchange giant Bithumb. This marks the first time a local financial regulator has allowed a fund to invest in cryptocurrencies. SO WHAT The approval for the two funds signals a shift in attitude from the South Korean government towards cryptocurrencies, as it continues its efforts to become a global hub for digital assets.

By: The Defiant Team

DeFi Daily

GM Defiers!

Today we’re covering Blur’s foray into NFT lending, which looks to combine features from peer-to-peer and peer-to-pool models. Meanwhile, decentralized social media protocol Lens is testing a new Layer 3 scaling solution as it gears up for increased activity.

✍️ In today’s newsletter:

Blur launches NFT lending protocol

🙏Sponsored:

📈 Markets in last 24 hrs:

BTC Bitcoin $29,241 -0.790% ETH Ether $1,893.3 -0.800% MKR Maker $699 -0.570% SPY S&P500 $414.44 +0.630% UNI Uniswap $5.51 -0.790% LDO Lido DAO $2.086 -2.61%

🎬 WATCH

Watch our 5-step guide to trading new tokens safely. And check out our podcast with Nader Dabit, director of developer relations at Aave/Lens.

NFT Leverage

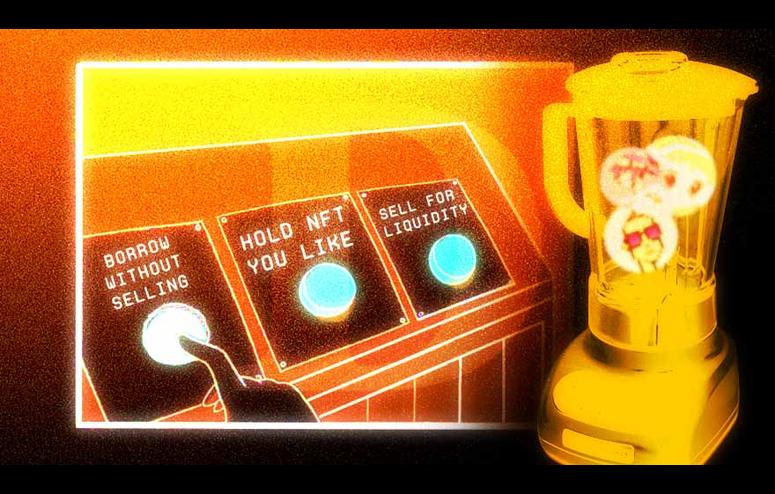

TLDR Blur has launched its Blend protocol, which enables traders to buy NFTs without bearing the full cost upfront. Borrowers can either acquire the token in full once they have the funds to repay the loan, or look to sell the asset if it appreciates, pocketing the difference. The protocol also features peer-to-peer lending, allowing users to borrow against their NFTs with specific amounts and interest rates offered by individual lenders.

SO WHAT The Blend protocol marks Blur’s entry into the NFT lending space and its latest move to establish itself as the go-to platform for NFT trading. However, the protocol faces competition from other projects such as NFTfi, PWNDAO, BendDAO, and ParaSpace, which also offer forms of collateralized NFT lending.

Sponsored

Etherisc, the open-source, decentralized insurance protocol and ecosystem, has taken the next step in making insurance fairer, more transparent and accessible for all.

Etherisc has launched a trio of exciting developments, including a powerful real world use case for decentralized insurance:

USDC Depeg Protection : Stablecoins should be stable. With the launch of the world’s first peer-to-peer parametric USDC depeg protection cover, stablecoin users can now avail of guaranteed peace of mind for their USDC deposits. Customers can sign up today to receive automated payouts should the price of the USDC stablecoin fall below its $1 USD pegged value for a period longer than 24 hours.

Stablecoins should be stable. With the launch of the world’s first peer-to-peer parametric USDC depeg protection cover, stablecoin users can now avail of guaranteed peace of mind for their USDC deposits. Customers can sign up today to receive automated payouts should the price of the USDC stablecoin fall below its $1 USD pegged value for a period longer than 24 hours. Peer-to-Peer Risk Pools : Etherisc is opening the insurance industry to an entirely new class of investors. USDT holders can now stake their capital to receive rewards through premiums paid by depeg protection customers. Risk pools are also used to cover the cost of payouts in the event of a depeg incident.

: Etherisc is opening the insurance industry to an entirely new class of investors. USDT holders can now stake their capital to receive rewards through premiums paid by depeg protection customers. Risk pools are also used to cover the cost of payouts in the event of a depeg incident. DIP Staking: Moreover, holders of Etherisc’s native ecosystem token can now also stake DIP to back peer-to-peer risk pools, for potential rewards.

Take out depeg protection cover or stake your USDT today at depeg.etherisc.com

Web3 Social Media

TLDR Decentralized social media protocol Lens, created by the team behind Aave, has started beta-testing Momoka, a bespoke Layer 3 scaling solution. Beta testers include Lenstube, Orb and Phaver. Momoka is an optimistic Layer 3 data availability layer that processes Polygon transactions off-chain to minimize fees.

SO WHAT Momoka is a significant step for Lens, as it will allow the protocol to better compete with traditional social networks while ensuring that users retain control over their content.

🔎 OUR REPORTERS ARE WATCHING

🌍 ELSEWHERE