First Mover Americas: Bitcoin's Within Range of $30K

TL;DR Bitcoin was rangebound over the weekend and into Monday as U.S. regulators continue to monitor crypto exchanges. Oil prices rallied from an OPEC announcement, potentially setting up a pivot away from last year's liquidity tightening and a potential boon for cryptocurrencies.

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

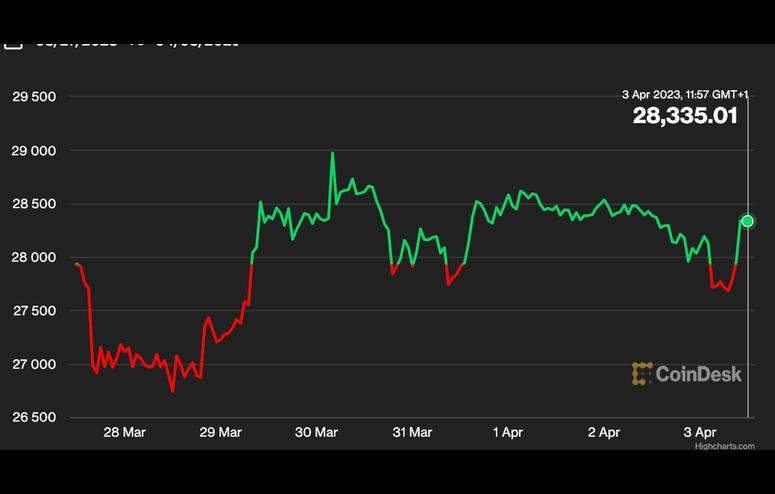

Bitcoin has been testing the $30,000 mark, as it traded between $27,500 and $28,900 over the weekend. The world’s largest cryptocurrency by market value was flat on Monday, while ether was down slightly. Simon Peters, an analyst at investment firm eToro, wrote in a morning note that as stock markets move back toward "bull territory," the crypto market appears to be moving in a similar direction. “While bitcoin will continue to test the $30K line, we might need a stronger push to see it higher,” he wrote. “Important labor market updates from the U.S. are inbound this week, which could influence prices in the short term.”

The U.S. government has a “substantial case on the merits” in its bid to quash a $1 billion deal by Binance.US to buy the assets of bankrupt crypto lender Voyager Digital, a New York judge said Friday. District Judge Jennifer Rearden said she would try to move quickly to settle a dispute, given that delays could cost as much as $10 million per month for the estate. U.S. Bankruptcy Judge Michael Wiles approved the sale early last month, but last week, Rearden said she would put that on hold while she considered objections from the government that the contract effectively rendered Voyager immune by exculpating it from breaches of tax or securities law.

Japan's Financial Services Agency said in a warning letter published on Friday that foreign crypto exchanges Bybit, BitForex, MEXC Global and Bitget are operating in the country without proper registration and thus violating the country's fund settlement laws. The regulator also said the list of unregistered traders "does not necessarily indicate the current state of unregistered business."

The chart shows oil prices lead the U.S. Consumer Price Index by six months.Oil prices need to stay low for central banks to pivot away from liquidity tightening that roiled asset markets, including cryptocurrencies, last year.Oil, however, surged early Monday on the Organization of the Petroleum Exporting Countries' unexpected decision to cut output by 1.16 million barrels per day.

GMO Financial Holdings Buys 10% of Crypto Hedge Fund AWR Capital for Undisclosed AmountU.S. Banking System Turmoil Has Spurred Bitcoin Outperformance: CoinbaseBalaji Srinivasan’s $1M Bitcoin Bet Could Be Right, but I Hope He’s Wrong