This Week on Crypto Twitter: SBF Pleads Innocence Via Excel, Twitter Reacts with Memes - Decrypt

TL;DR It was a busy week in the world of crypto, with Gemini and its creditor Genesis continuing their spat, National Geographic launching an NFT collection, and FTX’s former CEO Sam Bankman-Fried still insisting that his exchange is solvent. Porsche announced the mint price of its new 7,500-piece NFT collection, while a lucky solo Bitcoin miner won a sizable block reward. Genesis filed for bankruptcy, prompting DCG and Cumberland to issue statements on the matter.

Illustration by Mitchell Preffer for Decrypt

It was the third full week of 2023, the third full week of consecutive gains for all leading cryptocurrencies, and the third week of the ongoing spat between crypto exchange Gemini and its creditor Genesis. Naturally, there was a lot to talk about on Crypto Twitter.

On Monday, National Geographic took its first steps in the NFT world with the launch of its Genesis collection ‘GM: Daybreak Around the World.’ Judging by the comments, it was not a terribly smooth minting process.

Today is the day! Nat Geo’s Genesis collection ‘GM: Daybreak Around the World’ will go on sale at 12pm PT / 3pm ET! https://t.co/03vvZMbCB0 pic.twitter.com/Sdhfcv7bBK — Nat Geo Photography (@NatGeoPhotos) January 17, 2023

The following day, Maria Shen, an investor at crypto venture firm Electric Capital, shared key takeaways from the company’s fourth annual Developer Report. Topline takeaway? The blockchain developer space has continued to grow both throughout and despite the bear market.

2/ TLDR:

* Monthly devs grew 5% y/y while prices are down 70%+

* 23k+ monthly devs

* 471k monthly code commits

* 3.9k monthly devs in DeFi

* 61k NEW devs touched crypto code in 2022

* Several ecosystems outside of @ethereum have 500+ devs and are growing through this bear market pic.twitter.com/vP9KykJGQs — maria ⚡️ (@MariaShen) January 17, 2023

Crypto prices briefly dipped on Wednesday in anticipation of a U.S. Department of Justice announcement concerning a “major international cryptocurrency action.” Even Binance CEO Changpeng Zhao appeared to be spooked, but it ended up being about a little-known Chinese exchange called Bitzlato, prompting many memes and much hilarity on Twitter. Crypto prices quickly recovered on the reveal.

One lucky solo Bitcoin miner with a humble operation won a sizable block reward that day.

A solo #Bitcoin miner with only 10TH just won a block reward worth 6.25 $BTC (over $130,000). They beat once-in-a-lifetime odds 🤯 pic.twitter.com/DPOugZb8jX — Bitcoin Magazine (@BitcoinMagazine) January 20, 2023

German automobile titan Porsche announced the mint price of its new 7,500-piece NFT collection celebrating its iconic flagship sports car, the 911.

The iconic 911. Not only a number – a legacy. Unveiling our mint price of 0.911 ETH. — PORSCHΞ (@eth_porsche) January 20, 2023

FTX…

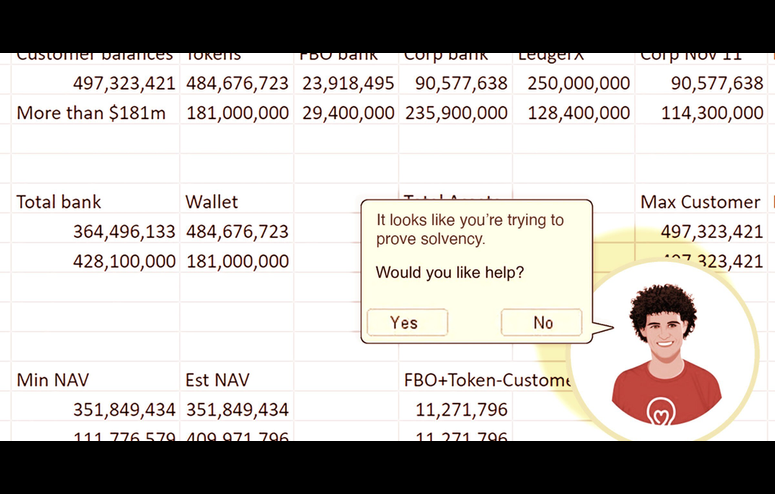

On Wednesday, Sam Bankman-Fried, the disgraced former CEO of FTX, who is currently under house arrest charged with eight financial crimes in connection to the exchange’s collapse, insisted that the FTX bankruptcy team is wrong about the insolvency of FTX US.

Bankman-Fried tweeted his latest Substack post, where he says FTX U.S “was and is solvent, likely with hundreds of millions of dollars in excess of customer balances.” Although replies were turned off, many quoted SBF’s tweet to meme his spreadsheet, or remind him that he really shouldn’t be tweeting anymore.

These funds, are they in the room with us right now? https://t.co/6spaLsHzob pic.twitter.com/msa6BwQrVj — sleazy wonder (@burnersburners) January 19, 2023

Bloomberg crypto journalist Muyao Shen that day tweeted a handy flowchart connecting the key players at the top of FTX’s former empire.

The following day, SBF reacted to a bit of news from his successor, bankruptcy lawyer John J. Ray III. Ray most notably chaired Enron Creditors Recovery Corp., a company that returned nearly a billion dollars ($828.9 million) to Enron’s creditors after the energy company in 2001 filed for what was, back then, the largest Chapter 11 bankruptcy in history.

I'm glad Mr. Ray is finally paying lip service to turning the exchange back on after months of squashing such efforts! I'm still waiting for him to finally admit FTX US is solvent and give customers their money back...https://t.co/XjcyYFsoU0https://t.co/SdvMIMXQ5K — SBF (@SBF_FTX) January 19, 2023

FTT jumps 33% on the news John Ray gonna make it all back https://t.co/8LXEcOO9Zf pic.twitter.com/Iy3BvlaviM — db (@tier10k) January 19, 2023

On Thursday, a crypto-loving lawyer who tweets as @MetaLawMan shared a ten-tweet thread highlighting stark differences in John J. Ray III’s handling of the FTX and Enron bankruptcies.

8/ In his testimony and affidavits, Mr. Ray vividly describes a veritable pageant of waving "red flags" at FTX that no competent lawyer could possibly have missed. And yet, Mr. Ray has no intention of holding these lawyers accountable for damages as he did in Enron. — MetaLawMan (@MetaLawMan) January 19, 2023

It’s now the third week of a feud that started at the beginning of the year when news surfaced that crypto lender Genesis allegedly owes users of Gemini’s Earn product $900 million.

Gemini exchange co-founder Cameron Winklevoss and Digital Currency Group (DCG) chief Barry Silbert—who wholly owns Genesis—locked horns over it again last week, before the United States Securities and Exchange Commission (SEC) got involved and filed a set of charges against both Gemini and Genesis alleging that Earn was an unlicensed security.

On Wednesday, there were reports that Genesis was preparing to file for bankruptcy.

UPDATE: @GenesisTrading prepares Ch. 11 bankruptcy filing. Expect an announcement no later than early next week (likely end of this week). **DCG doing all it can to protect the DCG brand name, even if it means sacrificing a portfolio company and it’s creditors. — Andrew (@AP_Abacus) January 18, 2023

Crypto trading company Cumberland, which operates under TradFi trading firm DRW, on Friday announced it had no exposure to Genesis.

Genesis’ bankruptcy filing today reflects misleading and incorrect information, and as part of our commitment to transparency, we are providing more details. pic.twitter.com/FbXlQRAsoE — Cumberland (@CumberlandSays) January 20, 2023

DCG Statement on Genesis Capital Chapter 11 Bankruptcy Filing: https://t.co/6SsWj4zo3R pic.twitter.com/j9e8R3mMZv — Digital Currency Group (@DCGco) January 20, 2023

Finally, crypto news account @WatcherGuru posted the growing list of bankrupt crypto companies.

Bankrupt #crypto companies 2022-2023: • Three Arrows Capital

• Hodlnaut

• Genesis

• BlockFI

• Zipmex

• FTX — Watcher.Guru (@WatcherGuru) January 20, 2023