First Mover Americas: Bitcoin Tops $21K, Outshines S&P 500, Gold

TL;DR Bitcoin briefly touched $21,000 on Monday, while ether continued its recent surge. Binance said it will let institutional investors post collateral with its custodian in cold storage wallets. The U.S. Trustee objected to FTX hiring Sullivan and Cromwell. Cryptocurrencies outperformed other assets last week.

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

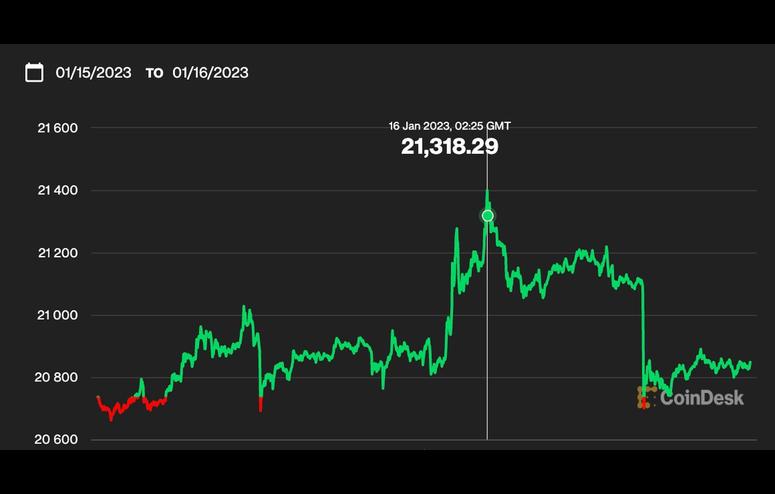

Bitcoin, the largest cryptocurrency by market capitalization, briefly reached the $21,000 mark for the first time since the FTX collapse in early November on Monday in early trading hours. The cryptocurrency has since retreated slightly, and is trading around $20,880. Ether also made gains over the weekend and is trading up 17% over the last seven days. While crypto assets surged on Monday, U.S. futures slipped. European stocks rose.

Binance will allow institutional investors to keep their collateralized crypto used for leveraged positions off the platform, Bloomberg reported on Monday. The exchange will let investors post collateral with Binance Custody, which will hold the assets off the internet in cold storage wallets, the report added.

The U.S. Trustee has voiced objections to FTX hiring New York law firm Sullivan and Cromwell, citing conflict of interest, in a Jan. 13 legal filing. The complaint echoes those made by a bipartisan grouping of U.S. Senators and by the crypto exchange’s founder Sam Bankman-Fried, and expresses concern the firm might tread on the toes of future work by an independent examiner.

The chart shows cryptocurrencies outperformed stocks and commodities by a significant margin last week.The safe-haven U.S. dollar depreciated, while government bonds were the worst-performing asset class.Crypto's outperformance comes after nearly two months of FTX-induced panic that saw market leaders bitcoin and ether wilt amid the risk revival on Wall Street.

– Omkar Godbole

Bernstein Expects Crypto Revenue to Jump to Around $400B by 2033Shiba Inu Developers Reveal First Look of Layer 2 Blockchain ShibariumBitcoin Surge Causes Over $500M in Liquidations, Highest in 3 Months