Binance Coin Price Prediction as German Car Manufacturer BMW Partners with BNB Chain – BNB to the Moon?

TL;DR Binance Coin price downtrend has cooled off, aided by a robust buyer congestion zone at $244. A bullish green candle forming on the four-hour chart could pave the way to a 7.35% triangle breakout. BMW, one of the leading German car manufacturers, has partnered with BNB Chain and Coinweb to add blockchain into its daily operations.

Binance Coin Price Prediction as German Car Manufacturer BMW Partners with BNB Chain – BNB to the Moon?

Binance Coin price downtrend has cooled off this week, aided by a robust buyer congestion zone at $244. The native exchange token has, since December 17, recouped 11% of the losses suffered this month to trade at $244 at the time of writing, not to mention the retracement from highs around $254.

A bullish green candle forming on the four-hour chart could pave the way to a 7.35% triangle breakout, but first, Binance Coin price must flip above the 50-day Exponential Moving Average (EMA) (in red at $245.8).

Binance Coin Price Prepares for Breakout after BNB Chain Partners with BMW

BMW, one of the leading German car manufacturers, has partnered with BNB Chain and Coinweb to add blockchain into its daily operations. According to a news article by Cointelegraph, this collaboration will help BMW create a blockchain loyalty program.

The partnership has been split into two phases, with BMW committing to integrating decentralized tech into the company’s daily operations to eliminate the tedious paperwork. In the second phase, the car manufacturer will develop and operationalize a loyalty program in collaboration with Coinweb.

The loyalty program will tap Web3 solutions to incentivize BMW Group customers. Customers will be grouped in tiers, considering their account status. Loyalty rewards will be distributed based on customer actions over time.

BMW customers will use the rewards to pay for goods and services offered by the company and in a connected ecosystem likely to come in the future. The BNB Chain was tapped to settle all transactions.

“Customers will be rewarded with loyalty points, and they will be able to spend within the ecosystem. Our hope is that there will be a future global rollout but currently our partnership is for Thailand,” Coinweb CEO, Toby Gilbert, told Cointelegraph.

Binance Coin Price Eyes 7.4% Short-term Bullish Move

BNB price is moving closer to a symmetrical triangle breakout, which might be a prelude to a longer uptrend. The partnership with BMW seems to have been received well, with investors looking forward to a long-term positive outlook for the token.

However, Binance Coin must uphold support provided by the lower triangle trend line to prevent a bearish breakout from stretching the leg to $225. It is worth mentioning that symmetrical triangles do not have bearish or bullish biases.

BNB/USD four-hour chart

Therefore, bulls must push the price past the 50-day EMA at $252, in confluence with the triangle resistance. A spike in volume and a break above this hurdle will affirm BNB’s 7.4% move to $264, where the price would encounter the 200-day EMA (in purple). This precise breakout target equals the distance between the widest points of the triangle extrapolated above the breakout point, as shown.

The Relative Strength Index (RSI) in the same four-hour time frame reinforces the bulls’ growing presence in the market as it climbs above the midline. Traders may fire up their long orders after the RSI crosses above the signal line (in yellow) and BNB clears the resistance mentioned at the 50-day EMA.

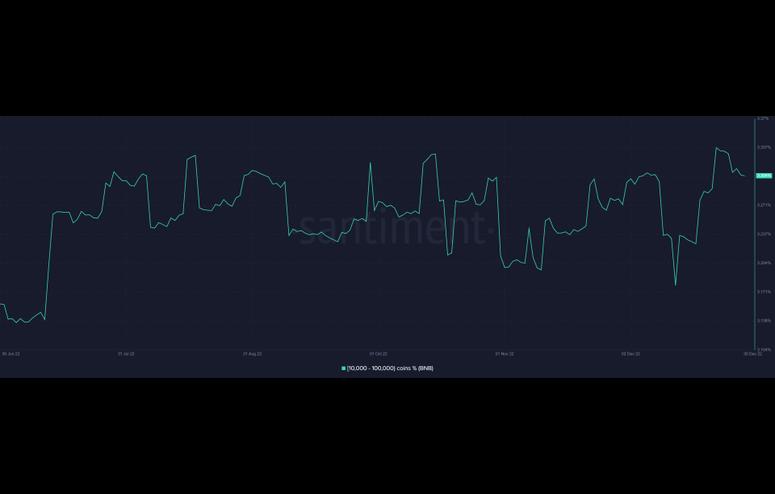

Large-volume holders have, since mid-December, reactivated the buying spree to scoop up more BNB before the year ends. According to Santiment, whale addresses with 10,000 to 100,000 coins now hold 3.3% of Binance Coin’s total supply, up from 3.18% on December 13 and 3.14% on July 4.

Spikes in this on-chain metric show that investor sentiment is improving as market participants forecast an optimistic outlook for BNB in 2023.

Binance Supply Distribution | Santiment

Altcoins to Consider

Most predictions for 2022 have gone down the drain, apart from bearish ones. The dilapidated market conditions push investors to consider changing their holdings ahead of 2023.

However, newer projects, backed with solid fundamentals, are known to offer above-average gains, with some going ahead to shape the crypto space. Interested investors may consider the altcoins listed here and currently in their presales to help them successfully navigate the crypto winter.

They say, “it takes a community to raise a child,” and FightOut believes it takes commitment and incentives to encourage a community to lead a healthy lifestyle. FightOut is approaching the fitness industry in a way not done before, at least not by existing Move-to-Earn (M2E) crypto platforms such as SweatCoin, STEPN and Step App.

The team behind FightOut is committed to changing the fitness industry one gym at a time with the help of an M2E fitness app. Users who join the platform will be rewarded for completing workouts and predetermined challenges.

FightOut aims to purchase a chain of gyms around the world for its members, as it plans to ease the masses in Web2 to Web3 using the metaverse.

FGHT presale is underway and is selling out fast. So far, $2.47 million has been raised by selling 1 FGHT for 0.0166 USDT.

Visit FightOut Now.

Dash 2 Trade (D2T)

Learn 2 Trade, a community of over 70,000 individuals, has been tapped to bring a world-class crypto analytics platform to life. Investors who never want to miss out on opportunities in the market may feel at home at Dash 2 Trade, knowing that they can access trading signals and social analytics using on-chain data to maximize profits.

All the holders and non-holders of D2T will have access to features on the platform through a free tier subscription. However, members can subscribe to the Starter and Premium tiers by paying 400 D2T and 1,000 D2T monthly. Dash 2 Trade presale has raised $11.49 million, far ahead of the first CEX listing on January 11.

Visit Dash 2 Trade Now.

C+Charge (CCHG)

The current electric vehicle (EV) charging system is inadequate and marred with issues such as the lack of standardization. On the other hand, the carbon credit industry, projected to be worth $2.44 trillion by 2027, is dominated by big corporations like Tesla, who lock out individuals driving EVs.

However, C+Charge hopes to drastically change the narrative by building a blockchain-based Peer-to-Peer (P2P) payment system for EV charging stations that will allow the drivers of electric vehicles (EVs) to earn carbon credits.

Visit C+Charge Now.