Here's What SBF is Facing After the SEC Charged Him With Fraud

TL;DR The US Securities and Exchange Commission has officially charged Sam Bankman-Fried, the founder of FTX, with defrauding investors. The SEC alleges that SBF concealed his diversion of FTX customers’ funds to crypto trading firm Alameda Research while raising more than $1.8 billion from investors. Potential penalties include injunctions, civil penalties, disgorgement of ill-gotten gains, and an officer and director bar.

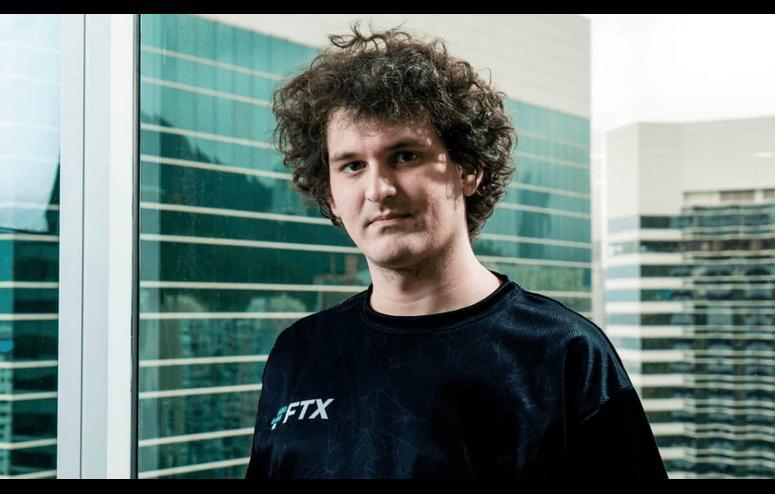

The United States Securities and Exchange Commission officially charged Sam Bankman-Fried with defrauding investors in FTX.

The Chairman of the SEC, Gary Gensler, said:

We allege that Sam Bankman-Fried built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto. After the arrest, @SBF_FTX is now officially charged with defrauding investors. SEC Chair @GaryGensler said: “We allege that Sam Bankman-Fried built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto.” pic.twitter.com/nps05okF5j — CryptoPotato Official (@Crypto_Potato) December 13, 2022

SEC Charges Sam Bankman-Fried

Earlier today, CryptoPotato reported that SBF was arrested in the Bahamas at the request of the US Government and that he might be extradited soon.

It appears that it didn’t take long for the securities watchdog to press formal charges, with the press release saying that the “defendant (read: SBF) concealed his diversion of FTX customers’ funds to crypto trading firm Alameda Research while raising more than $1.8 billion from investors.”

Per the complaint, the Bahamas-based FTX was able to raise more than $1.8 billion from equity investors, and at least $1.1 billion of that was from approximately 90 investors based in the US.

ADVERTISEMENT

During that time, SBF was promoting the venue as a safe and responsible trading platform. The complaint, however, says that SBF orchestrated a “years-long fraud”‘ aimed at concealing various factors from FTX investors, including:

undisclosed diversion of the customers’ funds of FTX to Alameda

undisclosed special treatment from FTX to Alameda

undisclosed risk of FTX from its exposure to Alameda

What Are The Potential Sanctions Against SBF?

The SEC’s complaint seeks injunctions against future securities law violations. The Commission also seeks an injunction prohibiting SBF from participating in the “issuance, purchase, offer, or sale of any securities, except for his personal account.

A civil penalty and disgorgement of his ill-gotten gains are also on the list. Last but not least is perhaps one of the most severe penalties in an SEC fraud case – an officer and director bar.