Bits Crypto Raises $1.2M to Facilitate Gradual Investments in Crypto

Fintech startup Bits Crypto has raised $1.2 million in pre-seed funding to build out its mobile crypto-investment application. The round was led by HOF Capital, the investor in such crypto companies as MoonPay, Stripe and Kraken, the company said Tuesday.

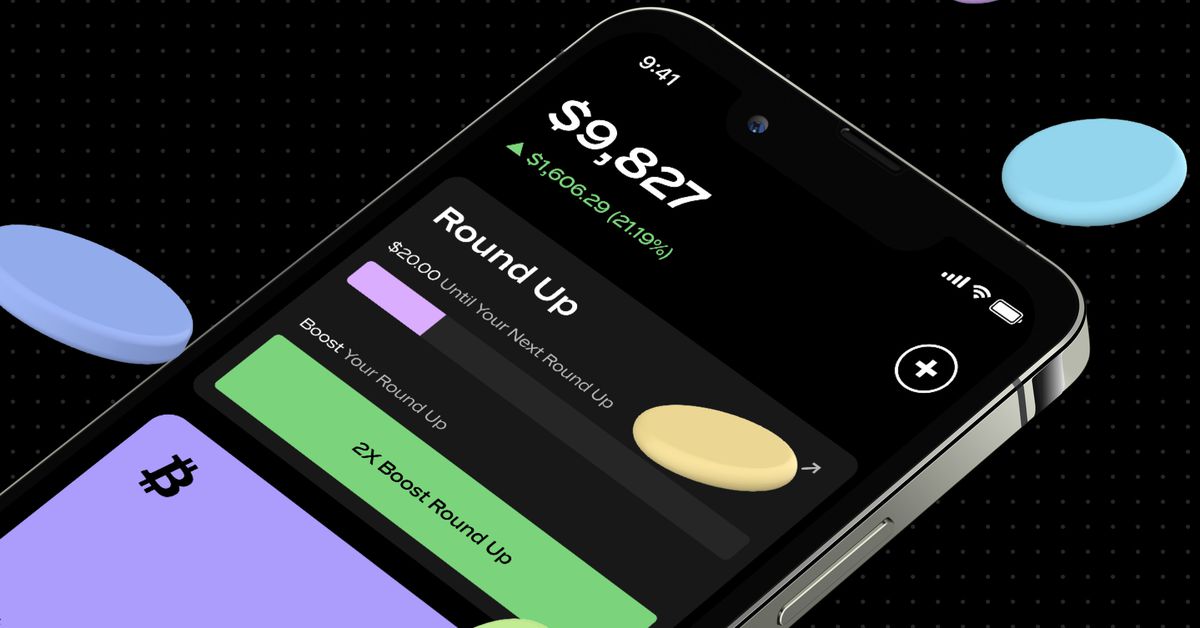

Bits allows users to invest their spare change in cryptocurrencies through automatic dollar roundups. Each user’s credit card transaction is rounded up to the next dollar and that difference is invested in cryptocurrency. Similar to investment platform Acorns, which automatically invests in a portfolio of stocks, Bits caters to users who want to dollar-cost average small amounts to build their portfolio of crypto investments over time.

“Everybody knows that crypto is hard. There's extreme market volatility, and that’s intimidating to first-time investors or wannabe investors,” Bits founder Jameson Rader told CoinDesk. “Fortunately, there is dollar-cost averaging, which is a proven financial strategy to minimize exposure and risk to market volatility.”

Dollar-cost averaging is a strategy in which investors put money into assets incrementally over time. It can be beneficial to those who want to spread their investment out, with a likelihood of seeing higher returns as opposed to a one-time, all-in investment.

Bits Chief Design Officer Nick Bembenek told CoinDesk that to start investing, users download the app and connect their credit cards. They then choose a basket of up to three currencies to allocate their investments across. Users spend money as usual, and with each transaction, the spare change rounded up to a dollar is deposited into the app. From there it’s invested across the basket in $25 increments to avoid heavy gas fees.

Bits also lets users select amounts for daily, weekly and monthly automatic investments.

Financial services companies such as Robinhood and Cash App currently offer crypto-roundup features. However, these require the use of these platforms’ native credit cards.

Rader calls this a “major product differentiator,” as Bits utilized banking software Plaid to allow users to plug in any debit card, credit card or bank account to begin roundups and scheduled investments.

Bits has integrated Coinbase for users to invest in tokens listed on the exchange as well as withdraw their profits via Coinbase wallet.

According to Chief Operating Officer Alex Poscente, the integration of Coinbase and Plaid allows the product to operate across all 50 states in the U.S.

It’s also building out educational content, called Tidbits, to educate and onboard users new to the crypto space on what tokens are available to purchase. After trending twice on Reddit as the top thread in the 5.1 million-member large cryptocurrency community for its beginner descriptions of every coin available on Coinbase, it's making an effort to make its application not only user-friendly but also educational for beginners.

An early user of Bits told CoinDesk that she likes the app’s orientation toward onboarding users new to the crypto space.

“It definitely has changed my view [of investing in crypto] in the sense that one, I'm not scared and two, I'm actually able to act and be active in this space as well, as an investor,” the user told CoinDesk.

The funding round also saw participation from venture capital funds Founders Inc. and Founders Committee.