Market Wrap: Bitcoin Extends Losses While Traders Remain Bullish on Ether

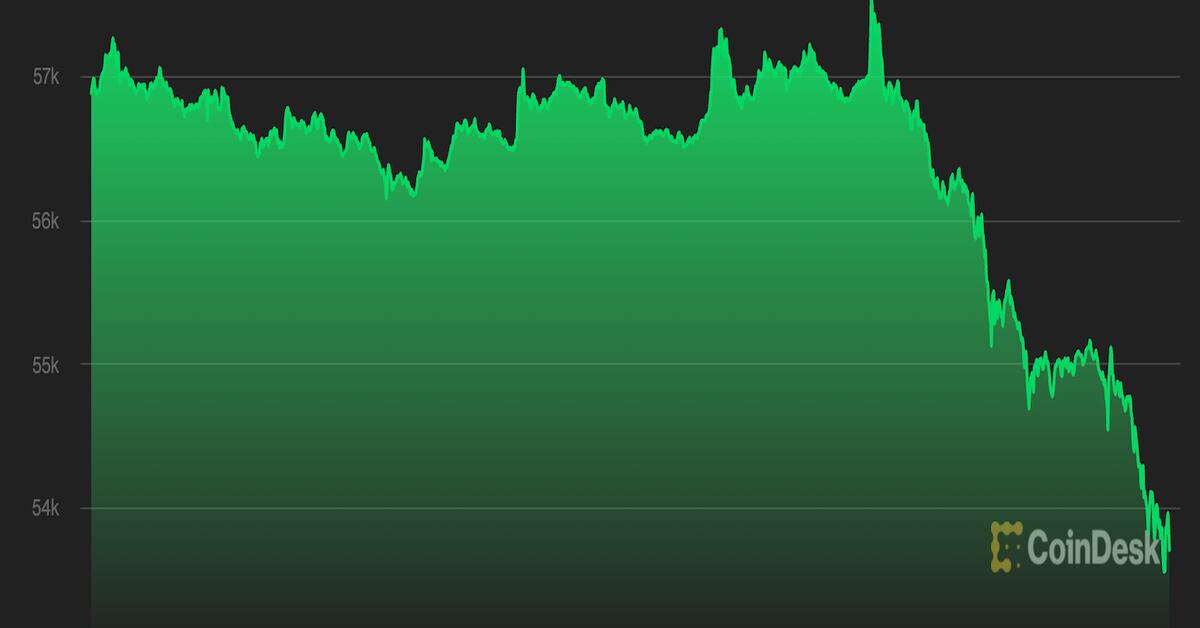

Cryptocurrencies were mostly lower on Friday aside from a few standouts such as Terra’s LUNA token, which was up about 9% over the past 24 hours. Bitcoin was trading at the lower end of its weeklong trading range around $53,000 at the time of publication, which is below its $1 trillion market capitalization.

BTC, the world’s largest cryptocurrency by market capitalization, is up about 2% over the past week compared to a 7% gain in ether and a 13% gain in Solana’s SOL token over the same period. The dispersion in weekly returns suggests that alternative cryptocurrencies (altcoins) are starting to outperform.

Some analysts are paying close attention to the slower pace of global monetary easing, which could reduce investors’ appetite for speculative assets such as cryptocurrencies and equities.

“In our view, the speed with which global liquidity contracts is the most important factor for cryptocurrency performance in the weeks ahead and possibly even into early 2022,” Coinbase wrote in a newsletter to institutional clients on Friday. The U.S. crypto exchange noted that overall market performance could be mixed heading into the U.S. Federal Reserve Open Market Committee (FOMC) meeting on Dec. 14-15.

“The steady unwinding of monetary accommodation in 2022 points to both lower returns for equities and losses for bonds, and greater volatility than over the past 20 months,” MRB Partners, a global investment research firm, wrote in a Friday report.

Ether, the world’s second-largest cryptocurrency by market capitalization, continues to struggle below its all-time price high of $4,865. The current pullback in ETH could stabilize around the $4,000 support level, although the price rally since the July low around $1,740 is starting to fade.

On a relative basis, ether is poised to outperform bitcoin if a breakout above 0.08 in the ETH/BTC ratio is confirmed next week. Charts still show significant resistance, which preceded downturns in ETH/BTC during the 2018 crypto bear market.

“This [pending] breakout is essential because it represents a resistance line going back to the 2017 top when one ETH was 0.15 BTC. The monthly close of the ETH/BTC chart was the highest bullish close in 45 months,” Lukas Enzersdorfer-Konrad, chief product officer at Bitpanda, wrote in an email to CoinDesk.

For now, the options market remains bullish on ether. The chart below shows the largest number of calls with an exercise price of $5,000 ETH.

Most digital assets in the CoinDesk 20 ended the day lower.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

Notable losers: